All closed position:

BABA: Long at 90.30, want to close above $93

BABA chart and Support level:

BABA Long: $95.91 and closed at $99.22

YHOO Shorted @ 42.51 want to close below $42

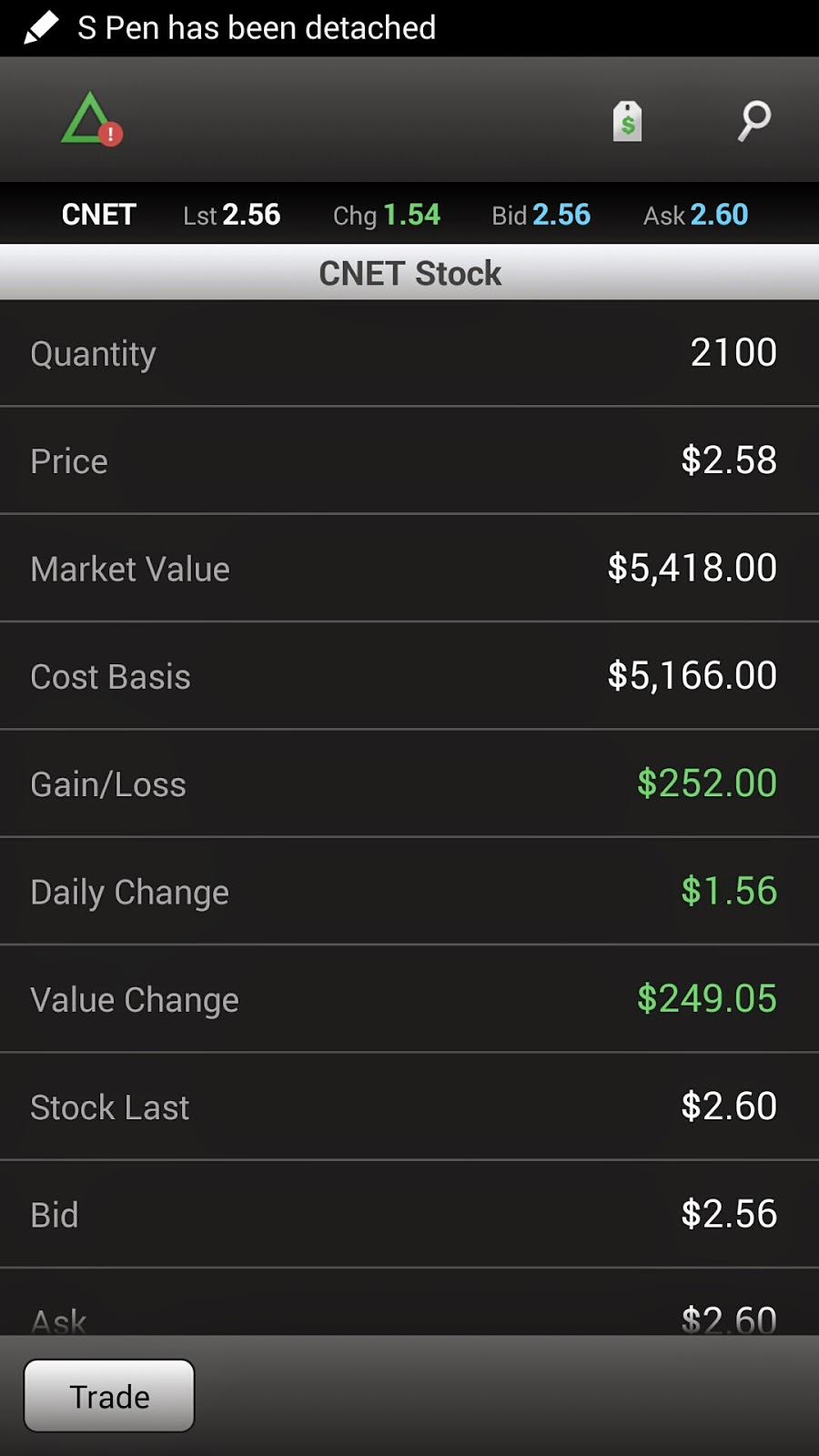

CNET Long: $2.40 closed at 2.56 and Long $2.21 and closed at $2.35

TRP Short @ 58.35 Closed at $57.66

DRC Short @ $81.91 closed at $81.15

FEYE Long @ 34.20 closed at 34.80

Day Trade Watchlist:

VHC, FEYE, BABA, YHOO, JBLU, RPRX, LULU, RWLK, MBLY, GPRO, DRC

In reaction to strong earnings/guidance: PDEX +28.6%

M&A news: CNQR +19.4% (to be acquired by SAP subsidiary, SAP America, for $129 per share),DRC +12.1% (following reports that company may receive $80/share bid from Siemens (:SI)),LULU +1.6% (Keybanc discussed VFC exec comments suggesting possible LULU deal)

Select Apple value chain related names showing strength:RFMD +1.3%, SWKS +1%, AVGO +0.8%, NXPI +0.7%

Select China related names showing strength ahead of BABA IPO: WB +1.7%, JD +1.1%, BIDU +0.8%

Other news: NAVB +10.5% (confirms it received Orphan Drug Designation from FDA for Use of Lymphoseek in Head and Neck Cancers),MCP +5.3% (Oaktree Capital Mgmt discloses 9.1% stake in 13G),HIMX +4.2% (climbed higher into the close after analyst suggested Google may replace Samsung OLED displays with Himax),JBLU +4.2% (announced that Robin Hayes, the company's current President, will succeed Dave Barger as CEO, effective February 16, 2015),INVN +3.4% (reports indicate that iPhone 6 contains InvenSense MP67B 6-axis Gyroscope),EMES+2.6% (initiated with a Buy at Goldman),MGA +2.5% (announces cooperation regarding regulatory investigation),SHLD +2.3% (Fairholme Capital Management disclosed 24% active stake in 13D filing),RBS +2.1% (following result of Scottish referendum),YHOO +1.9% (trading higher in advance of BABA IPO, also target raised to $48 from $44 at Piper Jaffray, tgt raised to $43 from $39 at Cantor Fitzgerald),WEN +1.7% (Trian Fund Management reports 24.39% stake in amended 13/D filing),RAD+1.5% (favorable commentary on Thursday's Mad Money),AMD+1.3% (co and Synopsys expanded their IP partnership),GILD+1.2% (announces European Commission granted marketing authorization for co's Zydelig),VOD +0.8% (in relation to Vivendi (VIVHY) authorized agreement with Telefonica (TEF) concerning the acquisition of GVT),GSK +0.8% (announces China investigation outcome; will pay a fine of GBP297 mln),HTZ +0.8% (China Partner, CAR Inc. announces IPO),NFLX +0.5% (officially launches in France, Germany, Austria, Switzerland, Belgium And Luxembourg)

Analyst comments: GLNG +4.5% (target raised to $110 from $75 at BofA/Merrill),FRAN +2.6% (upgraded to Buy from Neutral at Buckingham Research),AEO +2.4% (upgraded to Buy from Neutral at Goldman),NVAX +2.2% (assumed with an Outperform at Wedbush),ZION +1.2% (upgraded to Strong Buy from Outperform at Raymond James),VFC +1% (upgraded to Buy from Hold at KeyBanc Capital Mkts),FEYE +1% (target raised to $40 from $36 at Piper Jaffray),AMZN +0.8% (target raised to $435 at RBC Capital Mkts)

BABA: Long at 90.30, want to close above $93

BABA chart and Support level:

|

| BABA Chart and support level |

BABA Long: $95.91 and closed at $99.22

YHOO Shorted @ 42.51 want to close below $42

CNET Long: $2.40 closed at 2.56 and Long $2.21 and closed at $2.35

TRP Short @ 58.35 Closed at $57.66

.jpg) |

| TRP |

FEYE Long @ 34.20 closed at 34.80

Day Trade Watchlist:

VHC, FEYE, BABA, YHOO, JBLU, RPRX, LULU, RWLK, MBLY, GPRO, DRC

In reaction to strong earnings/guidance: PDEX +28.6%

M&A news: CNQR +19.4% (to be acquired by SAP subsidiary, SAP America, for $129 per share),DRC +12.1% (following reports that company may receive $80/share bid from Siemens (:SI)),LULU +1.6% (Keybanc discussed VFC exec comments suggesting possible LULU deal)

Select Apple value chain related names showing strength:RFMD +1.3%, SWKS +1%, AVGO +0.8%, NXPI +0.7%

Select China related names showing strength ahead of BABA IPO: WB +1.7%, JD +1.1%, BIDU +0.8%

Other news: NAVB +10.5% (confirms it received Orphan Drug Designation from FDA for Use of Lymphoseek in Head and Neck Cancers),MCP +5.3% (Oaktree Capital Mgmt discloses 9.1% stake in 13G),HIMX +4.2% (climbed higher into the close after analyst suggested Google may replace Samsung OLED displays with Himax),JBLU +4.2% (announced that Robin Hayes, the company's current President, will succeed Dave Barger as CEO, effective February 16, 2015),INVN +3.4% (reports indicate that iPhone 6 contains InvenSense MP67B 6-axis Gyroscope),EMES+2.6% (initiated with a Buy at Goldman),MGA +2.5% (announces cooperation regarding regulatory investigation),SHLD +2.3% (Fairholme Capital Management disclosed 24% active stake in 13D filing),RBS +2.1% (following result of Scottish referendum),YHOO +1.9% (trading higher in advance of BABA IPO, also target raised to $48 from $44 at Piper Jaffray, tgt raised to $43 from $39 at Cantor Fitzgerald),WEN +1.7% (Trian Fund Management reports 24.39% stake in amended 13/D filing),RAD+1.5% (favorable commentary on Thursday's Mad Money),AMD+1.3% (co and Synopsys expanded their IP partnership),GILD+1.2% (announces European Commission granted marketing authorization for co's Zydelig),VOD +0.8% (in relation to Vivendi (VIVHY) authorized agreement with Telefonica (TEF) concerning the acquisition of GVT),GSK +0.8% (announces China investigation outcome; will pay a fine of GBP297 mln),HTZ +0.8% (China Partner, CAR Inc. announces IPO),NFLX +0.5% (officially launches in France, Germany, Austria, Switzerland, Belgium And Luxembourg)

Analyst comments: GLNG +4.5% (target raised to $110 from $75 at BofA/Merrill),FRAN +2.6% (upgraded to Buy from Neutral at Buckingham Research),AEO +2.4% (upgraded to Buy from Neutral at Goldman),NVAX +2.2% (assumed with an Outperform at Wedbush),ZION +1.2% (upgraded to Strong Buy from Outperform at Raymond James),VFC +1% (upgraded to Buy from Hold at KeyBanc Capital Mkts),FEYE +1% (target raised to $40 from $36 at Piper Jaffray),AMZN +0.8% (target raised to $435 at RBC Capital Mkts)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

No comments:

Post a Comment